Give Me 6 Months and I’ll Show You How to Find a High Net Worth Investor to Secure at Least £450K in Funding Guaranteed

We help property founders create irresistible offers for angel investors. From strategy to pitch to signed deal.

Our Approach

This is for you if:

You're an entrepreneur or founder with a strong idea, business model, or investment opportunity.

You need help shaping your offer and finding the right investor to back you.

You're ready to grow but need funding to make it happen.

How we secure Angel Investment

Find out more about how we work:

What Exactly Is Equity Investing? (And Why It's Better Than Debt)

The Truth About Equity Splits

(It's Not As Bad As You Think)

Your 4 Exit Strategies (How You Actually Make Money & Get Out)

Why We Don't Find Investors FOR You

Investment Upfront vs. Payment at End (Why This Protects You)

Our Success Rate & What 'Average' Really Means

No Portfolio Yet? No Problem (What Actually Matters)

Bridging Finance vs. Angel Investors

Here's the Model That Has Investors Biting Your Hand Off

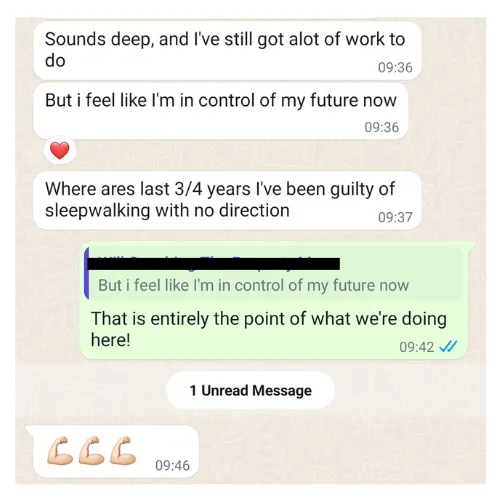

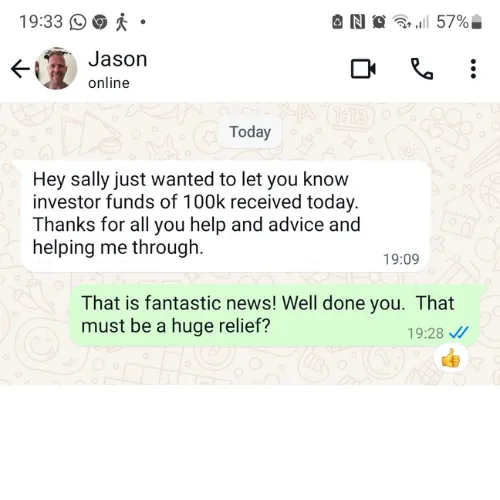

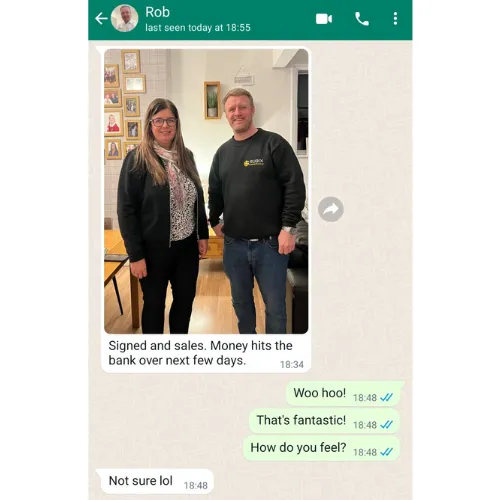

Hear From A Few Of My Clients:

Julia worked with us for 3 months and secured £500k

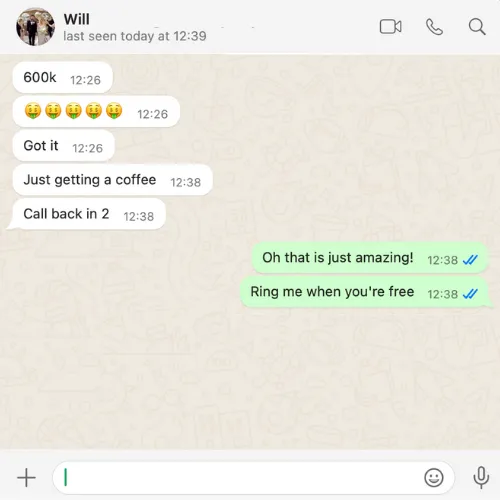

Will secured £600k from a high-net-worth investor

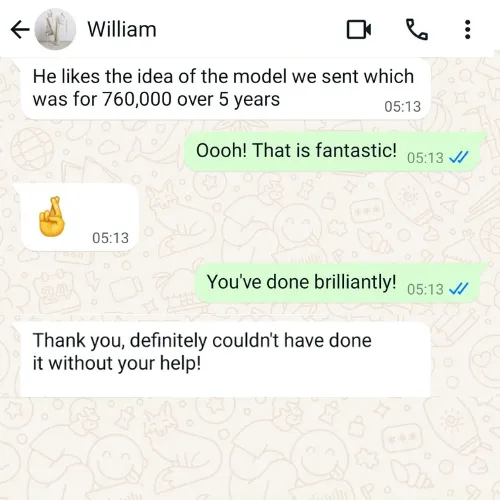

William secured £760k on a 5-year deal

Hi, I’m Sally, founder of the Portfolio Builder Academy. I work directly with founders like you to help you secure angel investment.

Whether you’re raising funds for a property deal or a new business, we help you build a solid, investor-ready proposition and get you in front of aligned investors.

Live Webinar Replay:

Want to know more about Sally, her background and how she learned how to fund-raise?

Our mission is to help you master....

Your dynamite offer

Your dynamite offer is the key to securing an Angel Investor. We guide you through the process of creating an offer so irresistible that investors bite your hand off

Access to verified high-net-worth investors

We show you where we source OUR investors. We can show you were they are, how to get them to talk to you and how to get them interested in YOUR offer

From pitch to signature

Clients that work with us become masters at closing deals.

Imagine if signing investors was actually easy and fun! That's what happens when you have the exact skills you need to succeed

Structure of your business

Structuring your business effectively is the key to an easy life down the line. We do things properly to protect your interests, to protect the investor's funds and to pre-determine exit routes.

Why is working with an Angel investor so life changing?

When I was investing using my own funds and using debt financing, I found I could grow my portfolio, but it was slow. I could only really add one property a year to my portfolio and I wanted more.

When I took on my Angel Investor in December 2020, suddenly I could buy 10 properties a year. I was able to turn a side hustle into a serious business where I got paid to do what I love, which is to buy profitable investment properties. From that moment onwards, I could see the path to financial freedom through growing my portfolio at pace and I've never looked back.

What's it like working with Sally?

Learn how to build your portfolio at pace by doing the bits you do best, and financing rapid growth through working with an Angel investor.

Develop a compelling business model that will get the investors coming to you

Get immediate access to verified high-net-worth investors

Learn how to monetise your role in the business so you can get paid whilst the portfolio is getting built

Learn how to contract legally with angel investors so that they feel confident and you're getting the best deal for yourself

Learn how to scale your team and avoid overwhelming yourself

Here's more from my clients....

HOW I CAN HELP YOU...

Here's What's Included In The Portfolio Builder's Academy

Step 1: Create an offer so compelling that investors bite your hand off

Watch our testimonial from Rob if you want to understand how important this part is. We work with you to take your property experience and ideas and turn it into a professional financial forecast that gets across to the investor what you're going to do and how it makes money. This is the thing that gives investors confidence in you. If you've been struggling to get investors to take you seriously, this is the bit that you need.

Step 2: Get "investor ready"

This is about showing investors that you’re serious, credible, and prepared. We help you document your track record, highlight your experience, and package up the key details on your model, risks, exits, and compliance. When investors start asking the tough questions, you’ll have everything ready, proving this isn’t just a nice idea, it’s a well thought-through opportunity they can trust.

Step 3: Get in front of verified high-net-worth investors

Once your deal is polished and you’re investor ready, it’s time to share it with the people who can actually back you. We help you get your opportunity in front of a wide network of High Net Worth individuals and angel investors who are actively looking for property deals. We give you access to our Angel databases and show you how to get in touch with them and more importantly how to get them interested in your offer. This gives you maximum exposure, more conversations, and the best chance of securing the funding you need.

Step 4: Understand how to contract with an investor

Investors will ask about terms early, and if you don’t have answers, you’ll look unprepared.

We help you define exactly how much equity to offer, what you’re comfortable negotiating on, and what’s non-negotiable. That way, when the time comes, you can hold your ground without losing the conversation.

We will also help you think through exit strategies and just as importantly, we’ll make sure the investor understands and agrees. We’ll also work with you to ensure this is properly reflected in your shareholder's agreement, so everyone’s expectations are aligned from day one.

Getting this right now protects your position and prevents conflict down the line and shows investors that you’re serious, professional, and clear.

Frequently Asked Questions

What are my chances of securing an investor?

If you have an equity share business model that makes money, you have a very good chance of securing an investor. People who have money are usually interested in growing it and owning property is considered to be a low risk investment because historically they go up in value.

Things that will make it hard for you to secure an investor are not marketing yourself, not telling anyone about your offer, fixating on individuals rather than scouring the whole market, skewing the business model too far in your own favour or being unwilling to negotiate. These are all things we can help you with.

What's the most someone has secured from an investor?

The largest amount secured so far is £1.3m. Consider the gauntlet thrown down.

What kind of people do you help?

This programme is suited to all manner of people including:

Property investors with 1 or more properties

Property management professionals

Deal sourcers

People with Rent to Rent properties

Entrepreneurs with other business experience

Construction professionals

Estate Agents

Surveyors

Investment specialists

Business consultants

What kind of experience do I need?

Its not necessary to already have a portfolio of properties, or to have already managed multiple renovations.

Think about the experience and knowledge that you have that we can leverage to create a good story around you as a portfolio builder. We can use any previous management/business experience to credentialise you.Your personality is likely to be more of a contributing factor to an investor coming on board with you than anything on your CV.

Conversley if you don't have any property experience at all, its going to be challenging to get an investor interested in your model, because it'll be hard to demonstrate that you know what you're doing. Zero experience founders have secured funding before, but it definitely helps if we can show the investor your credentials as a founder.

How does Sally know how to do this?

Trial and a lot of error!

Sally started her current portfolio in 2019 using her own money, but realised that growth was going to be super slow on her own. In 2020, after several months of failed attempts, she secured £700k from an Angel Investor on a 10 year deal and is currently building out that portfolio. Through this experience she learned what to offer, how to get an investor interested and on board with the proposal, and how to contract with them legally.

How is your programme different to all the others out there?

Essentially in three ways:

1) Sally's programme is specifically for people looking to grow a scaled portfolio using Angel investor finance. We don't run generic training sessions explaining the concept of BRRR. We focus on building out scaled financial models and getting ourselves investor ready so that we appeal to high net worth Angel investors.

2) Most people teaching how to secure Angel Investment, haven't' actually secured Angel Investment themselves. This is not a theoretical course, its a practical hands on coaching programme run by Sally who is currently in an equity deal herself.

3) Most other programmes restrict your 1:1 coaching time to a set call once a month. We offer an 'as and when needed' approach because in our experience of building scaled portfolios, when a client needs help, they need help now, not in three weeks time.

© 2025 SALLY KIFT PROPERTY COACH. All Rights Reserved.

DISCLAIMER: The figures stated anywhere on this funnel are my personal revenue figures and results and that of my clients. Please understand that I am not implying that you will duplicate them. I have the benefit of doing property investing for 10+ years, and have gained a solid experience as a result. The average person who simply purchases any “how-to” program may not follow through on what they are being taught and because of that I cannot guarantee any specific result. I am using these references for example purposes only. Revenue figures will vary and depend on many factors including but not limited to background, experience, and work ethic. All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, this is not for you.